China's Gold Demand: Saving, Not Spending

By Adrian Ash

What jewelry-selling Western consumers have discovered about China’s gold buying…

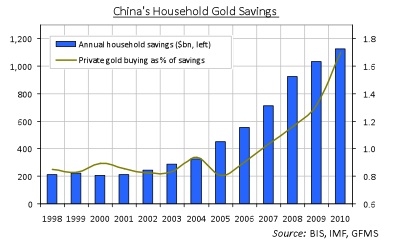

WHATEVER the reasons for China’s massive household savings rate (Western economists blame the lack of social security, so you can guess their cure), the World Gold Council’s Gold Demand Trends today showed private consumers putting ever-more money into physical gold.

Compared to household savings, in fact, revised forecasts here at BullionVault this morning put likely gold purchases in 2010 at the equivalent of almost 1.7% – over twice the level of five years ago.

This confounds Western analysts who foresaw substitution – from gold jewelry to consumer gadgets – as China’s household wealth grew. Because gold demand, even for the kitschest gold kitten, remains an expression of saving, not spending.

That might jar with Western tastes and ideas. But it’s clear in the numbers.

According to Peking professor Michael Pettis – and despite disposable income growth of perhaps 15% annually since 2000 – consumption growth in the world’s No.2 (and fastest-growing) economy “is anemic” by comparison. A BIS study last month suggested it’s because household earnings are falling as a proportion of national income. But either way, and in contrast with consumption spending, private Chinese gold demand has risen 26% annually by volume in the last decade, drawing a still-greater share of retained wealth as domestic gold prices rose near three-fold.

So where Western analysts divide “jewelry” from “investment” demand, Chinese gold buying – as in India, the world’s No.1 market (for now) – cannot be so easily split. Gold’s form doesn’t define its purpose so tightly in China, as North American and European gold sellers have rediscovered since the financial crisis began.

Swapping gold-for-cash by ditching unwanted jewelry, the Western world’s new “scrap gold” sources are simply finding in gold a value they’d forgotten was there. Stored wealth in whatever shape is still wealth. The trick, of course – and as China’s fast-growing “investment products” demand now shows – lies in reducing your transaction costs both on purchase and sale.

Adrian Ash

P.S: As for the People’s Bank buying gold, Beijing’s reserve managers are very much the junior player in China’s gold market. In the 30 months between Jan. 2008 and June 2010 alone, according to WGC data, private households bought more gold (1057 tonnes) than the central bank reports in its entire hoard (1054 tonnes).

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK’s leading financial advisory for private investors, Adrian Ash is the editor of Gold News and head of research at BullionVault – winner of the Queen’s Award for Enterprise Innovation, 2009 – where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2010

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.