London Gold Market Report

London Gold Market Report

by Ben Traynor

Friday 14 December 2012, 07:45 EST

Market’s Fed Reaction “Could Be Worrying Sign for Gold” as “Bear Stance Supported by Price Move”

SPOT MARKET gold prices looked to be headed for a third weekly loss in a row Friday lunchtime in London, after failing to break above $1700 an ounce, while stocks and US Treasuries were little changed on the day, with no signs of progress from Washington on the so-called fiscal cliff.

Silver was also headed for a third losing week in a row, trading around $32.60 an ounce for most of this morning, as other commodity prices gained slightly.

“A lack of activity has kept precious metals largely unchanged this morning,” says today’s commodities note from Standard Bank.

A day earlier, gold dropped back below $1700 an ounce Thursday, despite the US Federal Reserve committing to $45 billion a month in Treasury purchases the day before.

“The bulls were making the argument that the central bank would remain easy, at least until 2015, helping provide an element of support for gold,” says a note from Ed Meir, analyst at brokerage INTL FCStone.

“The bears countered that there would not be any additional easing in the pipeline between now and 2015, and also pointed out that the Fed did, after all, outline specific targets at which point it would start shrinking its bloated balance sheet…Thursday’s action seems to have supported the bearish stance.”

“It is perhaps a worrying sign that the latest installment of QE has had no positive impact on gold prices at all,” says a note from investment bank Natixis.

“No matter which side of the Fed argument one is on,” says INTL FCStone’s Meir, “we suspect that much of Thursday’s selling was also triggered by the fact that investors are becoming increasingly nervous about the lack of progress emanating from the fiscal cliff talks.”

President Obama and Republican House of Representatives speaker John Boehner had what statements from both parties called a “frank” meeting about the so-called fiscal cliff Thursday, adding that “lines of communication remain open” between the two.

No agreement has been reached on deficit reduction measures. Unless Congress passes new legislation, tax cut expiries and spending cuts worth an estimated $600 billion are due to kick in starting at the end of this month.

Barclays Capital meantime has cut its gold price forecast for 2013. BarCap forecasts gold will average $1815 an ounce next year, 2.4% down on the previous projection, while the investment bank’s forecast for silver is unchanged at $32.50 an ounce.

“We retain a positive view on the gold market,” a note from BarCap says, “but given gold’s outperformance during risk on intervals and our [foreign exchange] strategists’ expectation for the Dollar to strengthen beyond three months, we are revising down our forecast for 2013 modestly.”

Over in Europe, discussions on a common Eurozone budget and coordination of economic reforms among Euro members were put back until June next year Friday.

European Council president Herman van Rompuy issued a statement from the European Union summit in Brussels saying he will “present possible measures and a time-bound road map” at a summit in June next year.

Eurozone inflation meantime fell to 2.2% last month, down from 2.5% in October, according to official figures published this morning. US consumer inflation data are due to be published at 08.30 EST.

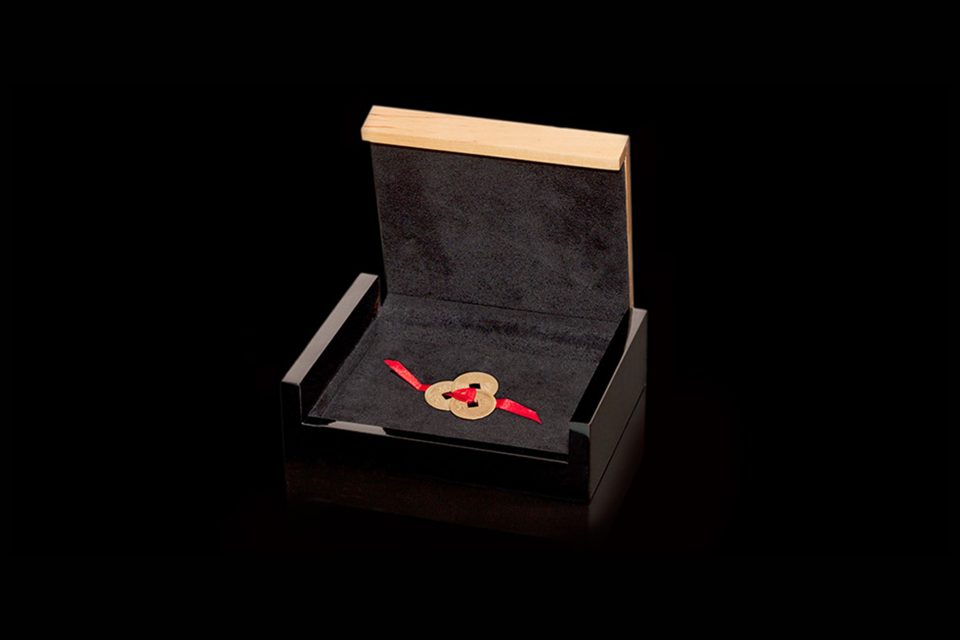

Demand to buy gold in physical bullion form has seen a resurgence in recent weeks, according to Standard Bank’s proprietary Gold Physical Flows Index.

Gold importers in the world’s biggest gold buying nation India continued to stock up Friday, newswire Reuters reports, to ensure adequate supplies for the wedding season.

“People feel this is a good buying opportunity as prices could jump another 1000 Rupees [per 10 grams],” says Harshad Ajmera at JJ Gold House.

Activity in China’s manufacturing sector meantime looks set to expand at a stronger pace this month compared to November, according to the provisional ‘flash’ purchasing managers index published by HSBC Friday.

China’s silver market meantime is “expected to achieve even further growth in coming years” on both the demand and supply side following a decade of rapid expansion, according to a report produced by precious metals consultancy Thomson Reuters GFMS and published by the Silver Institute Thursday.

“China is now the world’s second largest silver fabricator and is likely to become the second largest producer, with its share of global demand and supply standing at 17% and 14% respectively,” the report says.

Ben Traynor

Gold value calculator | Buy gold online at live prices

Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK’s longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. Ben writes and presents BullionVault’s weekly gold market summary on YouTube and can be found on Google+

(c) BullionVault 2012

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.