London Gold Market Report

By Adrian Ash

Weds 2 Feb., 09:20 EST

Gold Holds Flat, Shows “No Direct Link” to Mid-East Unrest as Beijing Advised to “Buy the Dips”

THE PRICE OF GOLD in Dollars held flat for the third day running Wednesday morning in London, trading at $1337 per ounce as silver ticked lower with broad commodity markets but copper prices pushed up to fresh all-time highs.

Clashes broke out in Cairo as protesters demanded President Mubarak leaves office now, not in Sept. as he offered this week, but the gold bullion market’s slack response during Egypt’s unrest suggests “there is no direct link between geopolitical risk in the Middle East and the gold price,” reckons one dealer in a note.

With China’s equity markets closed for the Lunar New Year holidays, Japanese and other Asian equities rose sharply, but European shares held flat overall after new data showed Factory Gate prices in the Eurozone rising at a two-year record of 5.3% in Dec.

UK construction activity also rose ahead of expectations, as did new US jobs as measured by the private-sector ADP Payrolls report.

“The downside target of the head and shoulders top [in the Gold Price] remains at $1265,” says Axel Rudolph in his latest technical analysis research for Commerzbank in Luxembourg, “which is right at the June 2010 high.

“Hence the whole region between the 2008-2011 uptrend line at $1296.37 and the $1227.20 November 2009 high could be revisited over the coming weeks before the gold price stabilizes.”

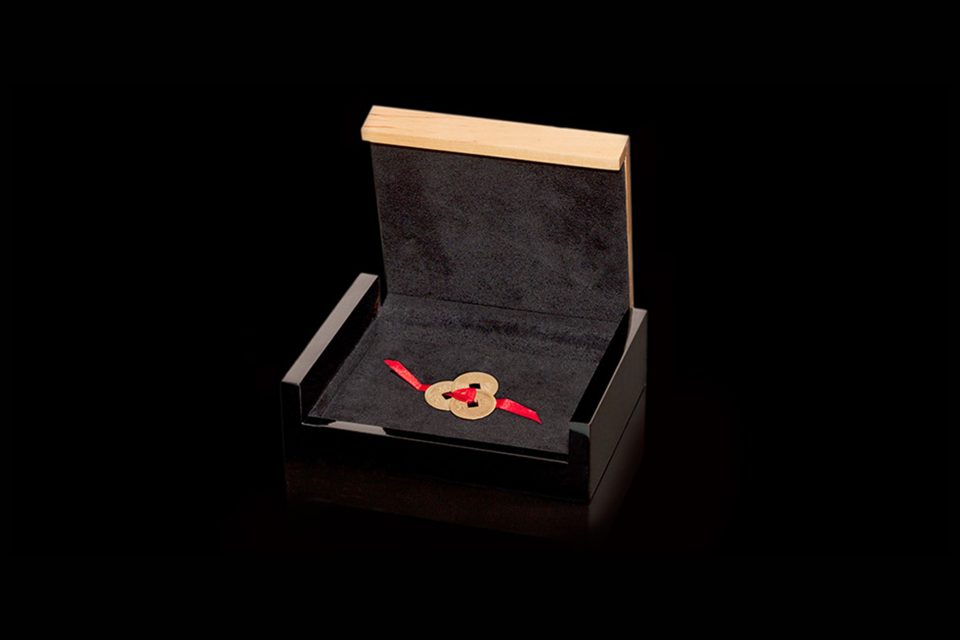

Following January’s 6% drop in the gold price, Chinese central-bank advisor Xia Bin yesterday repeated his call for the People’s Bank to maintain its “buy-at-a-low” strategy and grow its gold reserves, according to the privately-owned free English daily paper, the Hong Kong Standard.

“Increasing gold reserves can increase the amount of solvency, which is critical for the internationalization of the Yuan,” Xia said, adding that “the United States did not sell a single gram of gold, despite financial hardship in 2008.”

A 6% drop in gold prices in early November saw an un-named official talk up the prospect of central-bank buying in a Chinese stock-market journal.

Over the last 30 months, private Chinese households have bought as much physical gold as the People’s Bank officially reports all told.

“We must resolutely prevent [consumer] prices from rising too fast…and unswervingly do a good job of controlling the property market,” Chinese premier Wen Jiabao said Wednesday morning, visiting a former revolutionary army base in the central province of Anhui ahead of the Lunar New Year holiday.

Shanghai recently imposed new “wealth taxes” on second-home owners, and banking reserve ratios have been raised 7 times in the last 12 months.

Slipping to 4.6% on official data in Dec., consumer-price inflation in the world’s second-largest economy remained more than twice the rate of interest now paid on Chinese households’ massive bank savings.

“The single most important variable for gold is what the monetary authorities do,” said Dr Martin Murenbeeld, economist at South Africa’s Dundee Wealth Economics, on MineWeb‘s weekly radio show last night.

“What would put a damper on gold is if the authorities got ahead of inflation…if China jacked its interest rates up to 8% or 9%, and if India jacked its interest rates up by 10% or 12%.”

Such a move is unlikely, however, says Murenbeeld, because the world’s two most populous nations “are very concerned” that economic growth continues to provide enough new employment.

“During the [2009] recession, even China and India expanded their budget deficits very dramatically.”

Ireland’s government debt was downgraded on Wednesday for the second time in two months by the Standard & Poor’s rating agency, which cited the rising risk in Irish bankin debt – caused in turn by “the uncertainties surrounding the size of Ireland’s additional capital needs for its largely state-owned financial sector.”

On the currency markets today, the Euro slipped half a cent to the Dollar but held above $1.38, capping the gold price for German and French investors at €31,150 per kilo.

The British Pound jumped, however, rising above $1.62 and coming close to the 2010 highs set in Nov.

That squashed the gold price in Sterling back down to last night’s four-month lows at £823 per ounce.

Adrian Ash

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK’s leading financial advisory for private investors, Adrian Ash is the editor of Gold News and head of research at BullionVault – winner of the Queen’s Award for Enterprise Innovation, 2009 and now backed by the World Gold Council market-development and research body – where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.